17+ Years, More than 25000 clients and 10,000+

registrations done

Overview

The novel concept of One Person Company (OPC) in India was introduced by the Companies Act, 2013. This was primarily done to support entrepreneurs who are willing and able to start a venture on their own. This model allows an individual to create a single person economic entity. Section 2(62) of the Companies Act provides the definition of a One Person Company as a company that has only one person as to its member. Generally, members of a company are the people who have subscribed to the memorandum of association, or the company’s shareholders. Therefore, in furtherance of this understanding, an OPC is a company that has only one shareholder as its member. These companies are usually created when there is only one founder/promoter for the business such as entrepreneurs whose businesses lie in the early stages. These entrepreneurs now prefer OPCs over the sole proprietorship business model because of the several advantages that OPCs offer. One of the biggest advantages of an OPC is that it is a separate legal entity that is distinguished from its promoter. Therefore, it has its own assets and liabilities, which implies that the promoter is under no obligation to personally repay the debts of the company.

What Is The Process?

- At the outset, the primary first step in registration is confirming the availability of the proposed company name and the selection of up to six names in order of preference.

- Once the proposed name is approved or is available, we apply for the OPC registration.

- It is advisable to obtain a Digital Signature Certificate (DSC) if it’s not available with the party. It is an essential requirement during the form submission.

- Director Identification Number (DIN) is mandatory. It is advisable to obtain DIN if a Director does not have one.

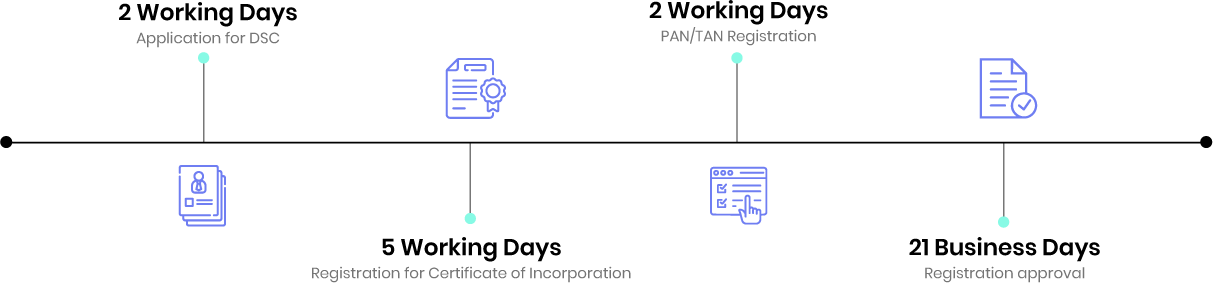

- OPC is incorporated within 10 – 15 business days from the date of application.

Details Required

- Proposed name of the company and the list of activities that the company will be engaged in.

- Suitably drafted Memorandum of Association (MOA) and Articles of Association (AOA), duly stamped with payment of stamp duty and signed.

- Address proof of the place of business of the OPC (Rent agreement in case of rented premises, Index II or property tax paid receipt, etc. in case of owned premises).

- Details of nominee and nominee’s consent.

- Identity proof of the sole shareholder, director(s), and nominee for the sole shareholder. (Passport, Voter ID, Driving License, Aadhar card).

- Address proof of the sole shareholder, director(s) and nominee for the sole shareholder (Should be in their name) (Any one of Bank Statement, Electricity

- Bill, Telephone Bill, Mobile Bill, Rent Agreement in case of rented premises).

- The initial capital of the company.

- PAN Card and other address proof of Director and Nominee.

- Affidavit and consent of Director

Timeline

Testimonials

Get Started

Frequently Asked Questions

1. Can there be more than one shareholder in an OPC?

There can be only one shareholder in an OPC and there should also be a nominee for the sole shareholder.

2. What is the role of a nominee?

A nominee can be termed as a person who will or is likely to become the shareholder of the OPC in case of death, disability of the original person to act as the sole shareholder of the OPC. The nominee should be an Indian citizen, and also should be residing in India.

3. Can a person incorporate more than one OPC’s?

A person shall not be eligible to incorporate more than one OPC or become nominee in more than one OPC.

4. Can the OPC be converted into any other type of company?

An OPC can be converted into any other type of company (Except section 8 Company), but only after a period of two years from the date of incorporation of the OPC.

5. Who can register an OPC?

As per the specifications of the Ministry of Corporate Affairs, any Indian resident can register an OPC, however, only one OPC at a time.

6. How much capital is required to start an OPC?

For registration of an OPC, an authorized capital of Rs. 1 lakh is required to begin with, but none of this actually needs to be paid-up. This means that you don’t really need to invest any money into the business.

7. Who is eligible to act as a member of an OPC?

Only a natural person who is an Indian citizen and resident in India shall be eligible to act as a member and nominee of an OPC.

8. Is there any tax advantage on forming an OPC?

There is no specific tax advantage to an OPC over any other form. The tax rate on an OPC is flat 30%. While other tax provisions like MAT & Dividend Distribution Tax apply similarly to any other form of a company.

9. Is there any threshold limits for an OPC to mandatorily get converted into either private or public company?

In cases where the paid-up share capital of an OPC exceeds fifty lakh rupees, or its average annual turnover of immediately preceding three consecutive financial years exceeds two crore rupees, then the OPC would be obliged to mandatorily convert itself into a private or public company.

10. What is the mandatory compliance that an OPC needs to observe?

The basic mandatory compliance is: -There should be at least one Board Meeting in each half of the calendar year. Moreover, the time gap between the two Board Meetings should not be less than 90 days. It is mandatory for the OPCs to maintain their books of accounts in a proper manner. Statutory audit of Financial Statements. Filing of business income tax returns every year before 30th September. Filing of Financial Statements in Form AOC-4 and ROC Annual Return in Form MGT.

11. Who cannot form a One Person Company?

- A minor shall not eligible becoming a member

- Foreign citizen

- Non Resident of India

- Any person incapacitated by contract

12. How do I convert an OPC to a Private limited company?

Mandatory Conversion of One Person Company (OPC) to Private Limited Company (PLC) is required in case a One Person Company meets certain parameters, like:

- The effective date of the increase in the paid-up share capital of a One Person Capital beyond rupees fifty lakhs,

- An increase in average annual turnover during the period of immediately preceding three consecutive financial years is beyond rupees two crores.

- In the above case, the One Person Company shall be mandatorily required to convert itself into either a private or a public company within a period of six months.