13+ Years, More than 25000 clients, and 3,000+ filings done

Overview

The CBIC formally notified the system of e-Invoicing under GST vide Notification No. 68/2019 – Central Tax, which inserted sub-rules (4), (5) and (6) under rule 48 of the CGST Rules, 2017 for the implementation of e-Invoicing. E-invoice, as the name suggests, is an electronic or digital invoice of the goods or services supplied by a registered person. It is a system where B2B invoices are authenticated electronically by GSTN for further use on the common GST portal. This system efficiently eliminates the need for manual data entry while filing GSTR-1 return as well as generation of part-A of the e-way bills, as the information is passed directly by the IRP to GST portal.

Generating E-Invoices is a hassle-free and an efficient way to keep a record of the invoices. Our personnel provide end-to-end support and service for each invoices of our client. We ensure that each invoice of our client is carefully registered on the GST Portal; thereby facilitating the same with IRN and QR Code.

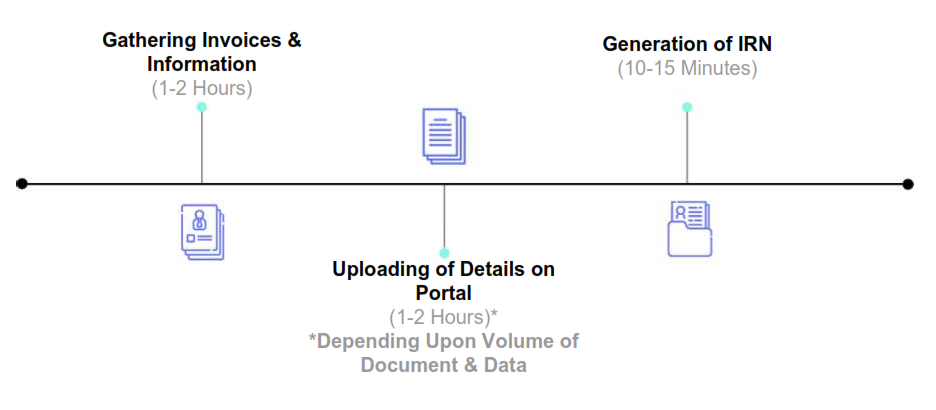

What Is The Process?

1. Information Gathering

The first step is sharing information pertaining to the invoices by the client with our team. Our team shall then generate e-invoices after the relevant invoices and login information are provided by the client.

2. E-Invoice Generation

E-invoice is then generated online through the concerned portal. The IRN generated is shared with client.

Documents Required

- Invoices

- Credit Note

- Debit Note

Timeline

Generation of E-invoices take around 1-2 hours after all the relevant documents are provided for.

Testimonials

Get Started

Frequently Asked Questions

1. What are IRN and QR Code?

When standard invoices are submitted on the GST Portal, in return it provides unique Invoice Reference Number (IRN) and QR Code. The IRN is a unique number allotted by the authorities and tagged to identify every invoice raised on the portal. Moreover, according to Notification No. 72/2019, QR code has been made mandatory in GST Invoices.

2. What is the eligibility?

IRN: The registered persons whose aggregate turnover in a FY exceeds INR 100 crore are required to issue e-invoice and generate IRN in respect of supply to registered persons (i.e. business-to-business or B2B transactions).

QR code: The registered persons whose aggregate turnover in a FY exceeds INR 50 crore are required to issue invoice having QR code in respect of supply to unregistered persons (i.e. business-to-consumer or B2C transactions).

3. Are there any exceptions to generating IRN and QR Code?

The following category of taxpayers are not required to generate IRN and QR code on their invoices:

- Insurer or a banking company or a financial institution, including an NBFC

- Goods transport agency

- Passenger transportation service provider

- A registered person supplying services by way of admission to exhibition of cinematography films in multiplex screens