17+ Years, More than 25000 clients, and 100+

startup registrations done

Overview

Through the Department of Promotion of Industry and Internal Trade, the Ministry of Commerce and Industry supports the country’s Start-Up ecosystem to facilitate entrepreneurs to set up new start-up ventures and thus catalyze the development of employment opportunities through them. In any economy, startups play a major role, they may be small in size, but generate a number of jobs that contribute to an improved economy. They also lead to innovation and competition and help to grow the economy of a country overall.

Criteria for entity registration as a start-up:

- The date of the entity’s incorporation should not exceed 10 years.

- The company is either incorporated as a Private Limited Company, a registered partnership firm, or a limited liability partnership.

- The company’s annual turnover for any financial year since its incorporation should not exceed INR 100 crore.

- The company should be an original company,

- The company should work to create or enhance a product, process, or service and/or provide a scalable business model with high potential for the creation of wealth & employment.

At IPLF, we have a committed and experienced team working on all kinds of government registration and are therefore well-positioned to help clients get DPIIT start-up recognition from scratch without any hassle. Our team is well versed in the process of obtaining start-up registration and will ensure a smooth process so that the different advantages that come with such registration are not overlooked by a qualified individual.

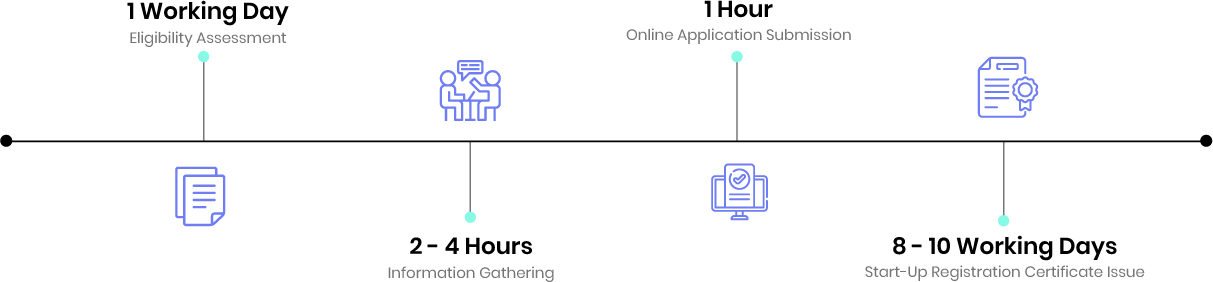

What Is The Process?

- The first step is to verify the entity’s eligibility to get recognition as a start-up.

- Our team then procures information/documents needed for online registration on the website of startup India.

- Our team will then prepare the online application with all the necessary information and documentation for successful submission.

- When the application and the attached documents have been carefully reviewed, the DPIIT grants the entity a certificate of recognition for start-ups.

Details Required

- Name of the company

- PAN of the company

- Full Address of the company

- Name and Details of authorised representative

- Directors and Partner Details of the entity

- Company Registration Number and Date

- Company Incorporation/Registration Certificate

- Brief description of the company’s nature of business

- Letter of recommendation/support from incubators or any state/central Government authority

- Number of employees in the company

- Funding proof, if required

- Focus areas of Research and type of products/services being rendered and explanation of revenue stream of the entity

Timeline

Testimonials

Get Started

Frequently Asked Questions

1. Is there an applicable fee payable to DPIIT for getting recognition?

No, for getting recognition as a start-up, the entities are not expected to pay any fee to the DPIIT.

2. What is the winding-up duration of start-up entitites?

A start-up has a simpler winding-up process, unlike most firms, and can be wound up within 90 days of filing for insolvency.

3. What are the IP benefits for a start-up entity?

A recognized start-up is expected to pay just 20% of the official IP (Patent, Copyright, Design, Trademark) filing fees and also has the fast-tracking advantage of its patent application. Attorney fees are not required to be paid.

4. What are the funding benefits available to start-ups?

A recognized start-up shall be eligible to get INR 2000 crore Credit Guarantee fund through the National Credit Guarantee Trust Company or SIDBI over a period of four years and INR 10000 crore funds of funds (i.e. the funds won’t be invested directly but through the capital of SEBI registered venture funds) from Alternative Investment Funds.

5. What are the tax benefits available to start-ups?

In accordance with section 80 of the IAC of the Income Tax Act, a recognized start-up can apply for a tax exemption and obtain an income tax holiday for a period of three consecutive years.

6. What are the consequences of providing incorrect information and documents while registration?

In such a situation, the start-up will be required to pay a penalty of fifty percent on the entity’s paid-up capital.

7. What is self certification of a start-up?

Self-certification enables start-ups to automatically comply with nine labor and environmental laws by logging into the ShramSuvidha portal without a three-year inspection.