17+ Years, More than 25000 clients and 5000+ filings done

Overview

Central Government levies and collects income tax on the income earned by any individual or business. Income Tax Return is filed with the Income Tax department by a salaried or self-employed individual, Hindu Undivided Family (HUF), companies or firms and the process of such filing is called Income Tax Return filing. Tax on the income earned by such business or individual is payable as advance tax in the same financial year, however, the calculation of income and tax liability is conducted in the Assessment Year. There are different forms and time limits, on the basis of certain eligibility criteria, for different taxpayers for filing the Income Tax Return.

We at IP and Legal Filings (IPLF) understand the importance of tax compliance and the process of online filing of Income Tax Return and hence making sure the filing of your return is smooth and correct.

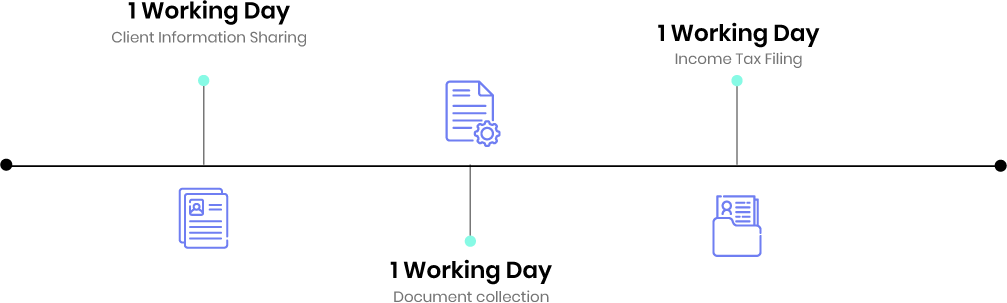

What Is The Process?

1. Assessment

The first step is a discussion between our team and the client, wherein basic details and information are shared. Our team then collects all necessary documents from the client and compute the income tax amount that is payable.

2. Preparation

After preparing the documentation, our team shall proceed with online filing of the Income Tax Return, on the receipt of the client’s confirmation

3. Finalization

Once the filing is done, acknowledging receipt of the Income Tax Filing is shared with the client and a copy is kept with our team for reference.

Details Required

- PAN Card of taxpayers

- Bank account statements

- Financial Statements

- TDS Certificate

- Aadhar card of taxpayers

- Details under section 80 of the Income Tax Act

Timeline

Testimonials

Get Started

Frequently Asked Questions

1. In case a business is in loss, is it still necessary to file Income Tax return?

Yes, Income Tax Return is necessary even in case of a loss in business as it may also help in carrying forward your losses for the financial year, and set off such loss against future profits until certain upcoming financial years.

2. What if I miss the Income Tax return filing deadline?

Income Tax Return should always be made in time. However, in case of missing the deadline, you can still file the return until a certain date as per the provisions of the ACT, by paying a late filing fees.

3. How to identify the correct Income Tax Return form?

Selection of the correct Income Tax Return form depends on the nature of the income, which is different for individuals, HUF, companies and so on. It is advisable to get professional help in case of doubts.

4. Can I revise my Income Tax Return?

Yes, it is possible to file a revised Income Tax Return. However, if the acknowledgement has been generated on a filing, revised filing can be done again until one year from the end of the financial year.

5. Is E-Filing of Income Tax Return necessary?

Yes, E-Filing of Income Tax Return is advisable and mandatory for all individual/business whose total income exceeds INR Five Lakhs. For income less than this amount, E-Filing is not necessary but is still advisable.

6. What happens in case of excess tax payment?

In such a case, the excess tax amount can be claimed as a refund by filing Income Tax Return upon the acceptance of the tax department. The amount is now mandatorily credited only to the online accounts that have the taxpayers PAN linked.

7. What are the precautions to be taken before filing an Income Tax Return?

Income Tax Return should always be filed before the due date to avoid late filing fees and miss out on certain other perks associated with it. While it is important to review all the documents carefully, it should be kept in mind that none of the documents shall be attached to the filing. It is necessary that the PAN number, bank account, Aadhar and other details are correct before filing. It is important to identify the correct return form on the basis of the criteria. It is a good practice to post the acknowledgement receipt of Income Tax Filing.

8. Is it necessary to link Aadhar for filing an Income Tax Return?

Yes, it is necessary to link Aadhar while making an Income Tax Return filing as per new Government rules. It is also necessary to link your Aadhar with your PAN card.

9. Is there an exemption of filing Income Tax Return?

An individual whose income is less than 2.5 lakhs per annum is not required to file an Income Tax Return.