17+ Years, More than 2,000 clients and 5,000

registrations done

Overview

The Department of Scientific and Industrial Research (DSIR) helps the in-house R&D units of companies that are engaged in manufacturing or production, or in rendering technical services, in getting recognition. Companies that are involved in contract research and those that are only presently engaged in research but have plans to start production at a later date are also qualified for recognition. In-house R&D units applying for DSIR recognition are expected to engage in innovative R&D activities related to the company’s line of business, such as the development of new technologies, design & engineering, process/product/design enhancements, the development of new analysis &testing methods; Research to improve productivity in resource usage, e.g. capital equipment, materials & energy; pollution control; waste product effluent treatment & recycling; or any other field of research. The company should have a dedicated and functional R&D unit engaged in innovative product and/or technology development when applying for recognition. After receiving recognition, it is valid for 3 years from the date of receipt of the recognition and can be extended by the renewal process for a further 3 years.

At IPLF, we have a committed and seasoned team working on all kinds of government registration and are therefore well-positioned to help customers get DSIR recognition and approval from scratch. We understand that the process of getting DSIR recognition and approval could be very intimidating for some customers, but our team will ensure a smooth process so that the major benefits that come with such recognition are not missed by a qualified company.

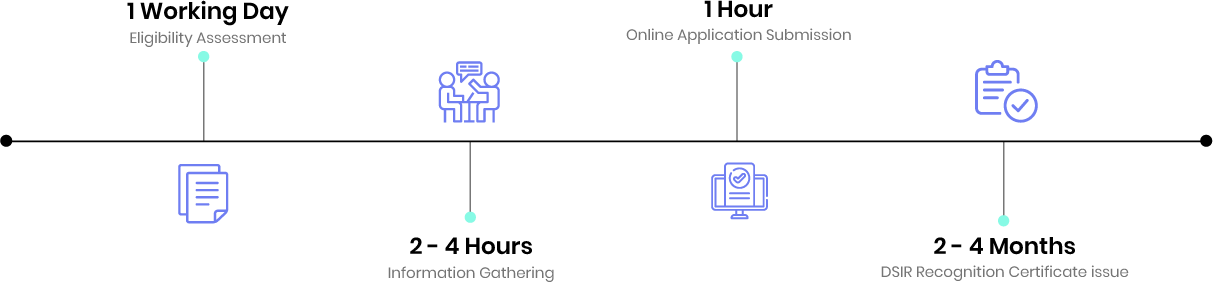

What Is The Process?

- The first step is to verify the client/entity’s eligibility to receive DSIR recognition. Our team carries out due diligence at a comprehensive financial, R&D facility and regulation, and management level to confirm whether the entity is eligible for DSIR recognition.

- As part of the DSIR recognition process, our team then assists in preparing the requisite paperwork and collecting the required information to register online on the DSIR website.

- Our team will then prepare the online application with all the necessary information for an efficient submission, and the hard copy of the application is then submitted to the DSIR.

- The DSIR sends a team to visit the company authorities and review the R&D center.

- The DSIR grants recognition or refuses it on the basis of its scrutiny after a thorough review of the records and physical inspection of the premises.

Details Required

- Name of the company and its nature of business

- PAN of the company

- Aadhar Number of the Applicant

- Company Registration Number and Date

- Brief History of the Company

- Structure of the company

- Certificate of incorporation of your company

- Address of the company and the R&D unit

- Capital structure of the company

- Annual turnover of the company in the last 3 years

- Number of manpower including the R&D sector

- R&D expenditures undertaken by the company in the last three years, current year and the upcoming three years (estimated).

Timeline

Testimonials

Get Started

Frequently Asked Questions

1. What are the benefits of getting DSIR Recognition?

The benefits of getting recognition of the in-house R&D units of your company are plenty:

- No custom charges on the R&D purchases

- An income tax benefit of around 150%

- Save around INR 15-17 lacs on per crore expenses on R&D

- Receive grants/funds from the Government

- GST benefits

- It gives your company a global branding

2. What kind of companies can apply for recognition of DSIR?

In order to get DSIR recognition, your company must be at least three years old. It’s also essential that the company is registered in India under the Companies Act and is involved in manufacturing or rendering software services.

3. Does the company need to show an annual turnover of one crore for getting DSIR recognition?

No, it is not essential to show an annual turnover of one crore. There have been many instances of MSME companies with annual turnover of less than one crore getting recognition.

4. What kinds of R&D activities are covered under DSIR Recognition?

- Any new product development of a product that the company is already making. It is not required to innovate a new product.

- Any new process development relating to reducing costs or value addition or reverse engineering of the existing product.

- Import substitution i.e. any product developed by a company which can replace an existing imported product

5. Can a Contract Research Company apply for recognition?

Yes, contract research organizations can apply for recognition of DSIR if they have an independent R&D Facility. However, these companies cannot avail the direct tax benefits under the recognition scheme.

6. Can a company with no manufacturing unite avail the recognition?

Yes, companies that are at least three years old and are engaged in R&D at present with future plans of setting up manufacturing unit can also avail the recognition services. However, these companies cannot avail the direct tax benefits under the recognition scheme.

7. Can research institutes apply for recognition of DSIR?

No, this scheme is only for companies involved in manufacturing and production.