13+ Years, More than 25000 clients and 10,000+

company registrations done

Overview

A Limited Liability Partnership (LLP) is an alternative form of a corporate business model that provides immense benefits. It is like an amalgamation of having the limited liability of a company and the flexibility of a partnership. The LLP is a separate legal entity and is liable to the full extent of its assets. However, the liability of the partners is limited to their agreed contribution in the LLP. Moreover, the LLP can continue its existence irrespective of changes in partners and is capable of entering into contracts and holding property under its own name. Furthermore, no partner is liable on account of the independent or un-authorized actions of other partners. Thus, LLP provides safeguards to individual partners from joint liability that arises out of another partner’s wrongful business decisions, misconduct, or negligence. The structure of governing a Limited Liability Partnership is flexible and similar to any other partnership firm, attributable to the fact that LLP is governed by a contractual agreement between parties.

The essential requirements for the formation of an LLP are as follows:

- There is a requirement of at least two partners (designated partners), either a natural person or any other legal entity, and at least one of them should be a resident of India.

- There should be a registered office in India.

What Is The Process?

- Firstly, the party needs to check the availability of the proposed name and select up to six names in order of preference.

- Once the proposed name is approved or is available, the party should apply for an LLP registration within 90 days of the name approval.

- It is advisable to obtain a Digital Signature Certificate (DSC) if it’s not available with the party. It is an essential requirement during the form submission.

- Obtaining a Designated Partner Identification Number (DPIN) is mandatory for all the Partners. It is thereby, strongly recommended that a partner obtains DPIN if he/she does not already have one.

Details Required

- PAN card acts as a primary ID proof

- Residence Proof of Partners

- Proof of Registered Office Address

- NOC from the landlord in case of rented office

- Passport size photograph

- Passport (in case of Foreign Nationals/ NRIs)

- Proof of address for NRIs

- LLP Agreement within 30 days of LLP Incorporation

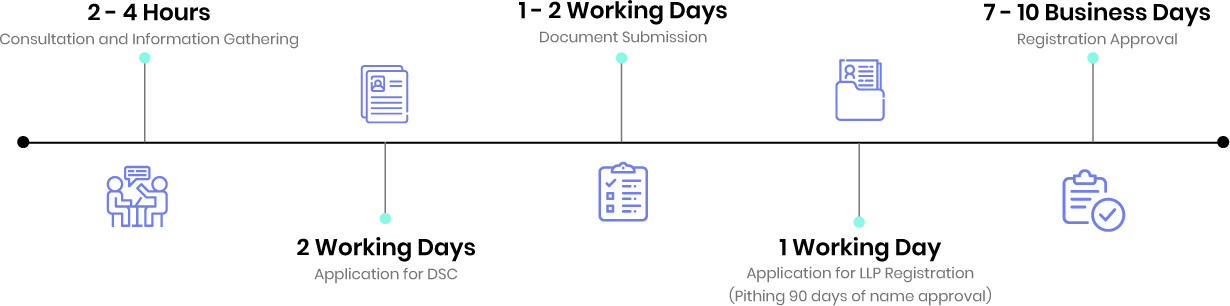

Timeline

Testimonials

Get Started

Frequently Asked Questions

1. What is LLP agreement?

An agreement to form an LLP is an agreement that is executed by all partners after LLP incorporation in India. This agreement outlines all the clauses related to business, including but not limited to the rights, roles, duties, and responsibilities of partners in LLP. It is essential that an agreement is filed within 30 days of the issue of a certificate of incorporation, as failure to do the same would amount to a fine of Rs. 100 per day till the date of filing.

2. How is the stamp duty amount decided for LLP agreement?

While determining the rate of stamp duty on the LLP agreement in India, the amount of capital contribution is taken into consideration. The rate of stamp duty on an LLP agreement varies from State to State. The State Stamp Act will be applied depending on where the registered office is situated.

3. Can an LLP carry on multiple business activities?

Yes, a Limited Liability Partnership registered in India has the autonomy to carry out more than one business. However, at the same time, this autonomy is limited as it is subject to the relevancy of the business. The activities must be related or should be of the same field. Unrelated activities, for example, Interior Designing and Legal consultancy cannot be carried under the same LLP. The business activities are mentioned in the agreement and must be approved by RoC.

4. Can you register LLP at your home address?

Yes. An LLP can be registered at your home address.

5. What is LLP Annual Filing?

LLP Annual filing includes the following components: Annual Return Statement of the Accounts or you can say Financial Statements of the LLP Income Tax Returns Filings.

6. Do I need to be physically present to incorporate an LLP?

No. This process is completely online and physical presence is not needed.

7. How can an existing partner cease to be a partner of an LLP?

A person may cease to be a partner in accordance with the agreement or in the absence of an LLP agreement, by giving 30 days notice to the other partners. Moreover, notice is also required to be given to ROC when a person becomes or ceases to be a partner or for any change in partners.

8. Whether the Registrar has any power to call for information from LLPs?

Registrar has the power to obtain such information that he considers or may consider necessary for the purposes of carrying out the provisions of the Act, from any designated partner, or employee of the LLP. He also has the power to issue summons to any designated partner, or an employee of an LLP before him for any such purpose. The power of summoning is relevant especially in cases where the information has not been furnished to him or in case the Registrar is not satisfied with the information furnished to him. Any person who fails to comply with any summons or requisition of the Registrar under this section, without any legal justification, shall be punishable with a fine not be less than two thousand rupees but which may extend to twenty-five thousand rupees.

9. Is there a requirement to file an Annual Return by an LLP?

Every LLP is obligated to file an Annual Return with ROC. A duly authenticated Annual Return in e- Form-11 is to be filed with the Registrar, in tandem with the prescribed fee, within a period of 60 days from the closure of every financial year.

10. How can a person become a partner of an LLP?

The partners in an LLP shall be those people who subscribed to the “Incorporation Document” at the time of incorporation of LLP. Subsequent to the process of incorporation, there is also an allowance for new partners being admitted in the LLP as per conditions and requirements of the LLP Agreement.