17+ Years, More than 3,000 clients and 5,000+

registrations done

Overview

Professional Tax (PT) is a tax levied by many Indian states on profession, employment and trade. Article 276 of the Indian Constitution allows the state government to levy and collect a tax on professions, trades, callings, and employments. As a result of this, this tax is applicable in certain Indian states, and each state has come out with it’s own law in this regard, with it’s own set of registration criteria, tax rates, compliances and exemptions. Therefore, individuals and business entities are required to check beforehand about the States where they are required to register themselves or their business under the state’s Professional Tax.

Professional Tax is applicable in most of the Indian states, including major Indian states like Maharashtra, Karnataka, Telangana, Tamil Nadu, Gujarat, Punjab. It is not applicable in Union Territories including Delhi, and the states of Haryana, Uttar Pradesh, etc. In case of employment, Professional Tax is deducted by the owner of the business, that is, the employer. Most states follow a slab system based on the income to levy professional tax rates. As per the Indian Constitution a cap of Rs. 2,500 per year has been fixed. Therefore, states such as Maharashtra levies Rs. 175 per month on those earning between Rs. 5,001 and Rs. 10,000 and Rs. 200 per month on those earning above Rs. 10,001, while the state of Karnataka charges Rs. 150 for those earning between 10,000 and Rs.14,999 and Rs. 200 per month on those earning above Rs. 15,000.

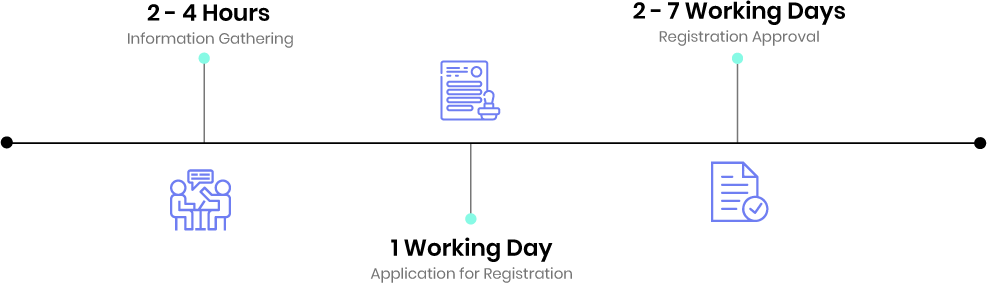

What Is The Process?

1. Consultation

Our representative will get in touch with you to understand the nature of your business and to guide you through the applicable Professional Tax registration process. Check out the details required section for documents required in the process.

Details Required

- Name, Address and Business Type of the applicant

- Phone Number and Email ID of the Applicant

- Permanent Account Number (PAN) of the Applicant

- Aadhar of the Applicant

- Total number of Employees working

- GST Registration details

- Passport size Photograph

- Bank Account details with proof

Timeline

Testimonials

Get Started

Frequently Asked Questions

1. What is a Professional Tax?

It is a form of Direct Tax levied by the many Indian States on Professions, Employment, and Trade. Salaried Employees, Professionals, Traders, Businessman Earning above a set limit are required to pay this tax.

2. In which states is the professional tax applicable?

Professional tax is applicable in the Indian states of Andhra Pradesh, Assam, Bihar, Chhattisgarh, Gujarat, Jharkhand, Karnataka, Kerala, Madhya Pradesh, Maharashtra, Manipur, Meghalaya, Mizoram, Nagaland, Odisha, Puducherry, Sikkim, Tamil Nadu, Telangana, Tripura, and West Bengal.

3. Is professional tax mandatory?

Yes, it is mandatory once applicable to the person/ entity.

4. How is the professional tax calculated?

The rate at which Professional tax is calculated to be paid may vary from state-to-state. The total taxable amount will not exceed Rs. 2,500. Most states have certain income slabs to determine the monthly/ quarterly/ yearly Tax rates applicable to them.

5. How is professional tax paid?

The tax is paid to the concerned state department on a monthly, quarterly, or yearly basis. In the case of salaried employees, etc., the employer is liable to pay the Professional Tax to the state government by deducting the same from the salary. Individual professionals working independently are required to pay the amount on their own.

6. Who is responsible for deducting the tax and depositing the same with Government?

In case of individuals who are self-employed, the tax has to be paid by the individual himself In case of employed individuals, the liability is on the employer.

7. Can the professional tax liability amount be paid in a lump sum?

In certain states, there is a concept of composition scheme. For e.g. in case of Maharashtra, the government announced a composition scheme under which any person liable to make payment to government at a rate of Rs. 2500 may make a lump sum payment in advance of Rs. 10,000 and his liability to pay for 5 years will be discharged.

9. What is the penalty for furnishing wrong information?

The penalty prescribed as per section 5(6) for giving false information in an application for Registration Certificate or Enrolment Certificate is equal to three times the tax payable under the Profession Tax Act.

10. What are the advantages of payment of tax?

The Enrolment Certificate holder can discharge his liability for the next five years by making payment in advance of a lump sum amount equal to four times of such rate of tax on or before 30th June, so advantage in paying lump sum is that of, saving of one year’s liability.

11. What is the enrollment certificate that is obtained by self-employed persons?

An employer who deducts the tax from the salary of the employee and pays to the government, such entity shall obtain registration certificate while employer if not deduct professional tax then the individual shall get enrolment certificate from necessary authority.